Canton Network 101 in Simple Terms

I've aimed to explain the Canton blockchain simply and give a preview of the network's future. This article will be updated as Canton Network evolves—bookmark it so you don't miss out!

I’ve spent over 500 hours researching the history of the Canton Network and reviewing all public documentation for you to create this brief Canton Network 101 guide.

Contents

Development Stages:

Canton Coin – What is the future Price?

(Instead of conclusion)

Before discussing Canton’s future, it’s important to know who was responsible for the network’s creation.

The Roots of the Canton Network

The Canton Network was announced in May 2023 and began testing with a consortium of over 30 financial institutions. All of these organizations share a common membership in the Global Synchronizer Foundation (GSF), which was recently renamed the Canton Foundation (CF).

https://x.com/CantonNetwork/status/1970165273400340920

What’s special about the Canton Foundation?

I’ll discuss the Canton Foundation’s role in the Canton Network in more detail later.

A key fact is that the Linux Foundation founded the Canton Foundation.

Most readers are familiar with this organization through its well-known product, the Linux operating system, which is widely used and beloved by many programmers.

OG have probably seen this penguin :)

In fact, Linux is much more than just an open-source operating system

Today, the Linux Foundation (LF) is:

More than 1,000 member companies, including Google, Microsoft, IBM, Intel, Huawei, Samsung, and others.

It supports projects with contributions from tens of thousands of developers worldwide.

It manages budgets of hundreds of millions of dollars for developing open-source ecosystems.

Hundreds of projects are under the LF umbrella, including Kubernetes, Hyperledger, Node.js, the Cloud Native Computing Foundation (CNCF), the OpenJS Foundation, and others.

The Linux Foundation deserves a separate article. In short, it is the “heart of global open source,” bringing together corporations and communities for collaborative technology development.

Why does it matter?

In March 2024, 155 organizations (including 15 asset managers, 13 banks, 4 custodians, 3 exchanges, and others) participated in the Canton Network pilot, including well-known companies such as BNY Mellon, BNP Paribas, Standard Chartered, and Goldman Sachs. Most of these firms are members of the Linux Foundation.

The image here shows just a few of the companies that make up the Canton ecosystem... I’m sure you’re familiar with most of them.

The full list of institutional players supporting Canton can be found here: https://www.canton.network/ecosystem

I promise you’ll be impressed!

⚠️Important Fact!

Since October 2025, Canton Foundation has grown enough to become an independent organization and is no longer under the Linux Foundation's management.

Having discussed the origins, let’s now revisit the question.

What is Canton Network?

✅Canton Network is a Layer-1 blockchain built specifically for institutional financial markets.

This is a complex and somewhat vague definition, which I personally find unappealing.

For now, it’s evident from these words that Canton is an independent blockchain network (since it’s Layer-1!), which must adhere to strict regulations and transparency standards.

✅The most essential thing for you to remember is that

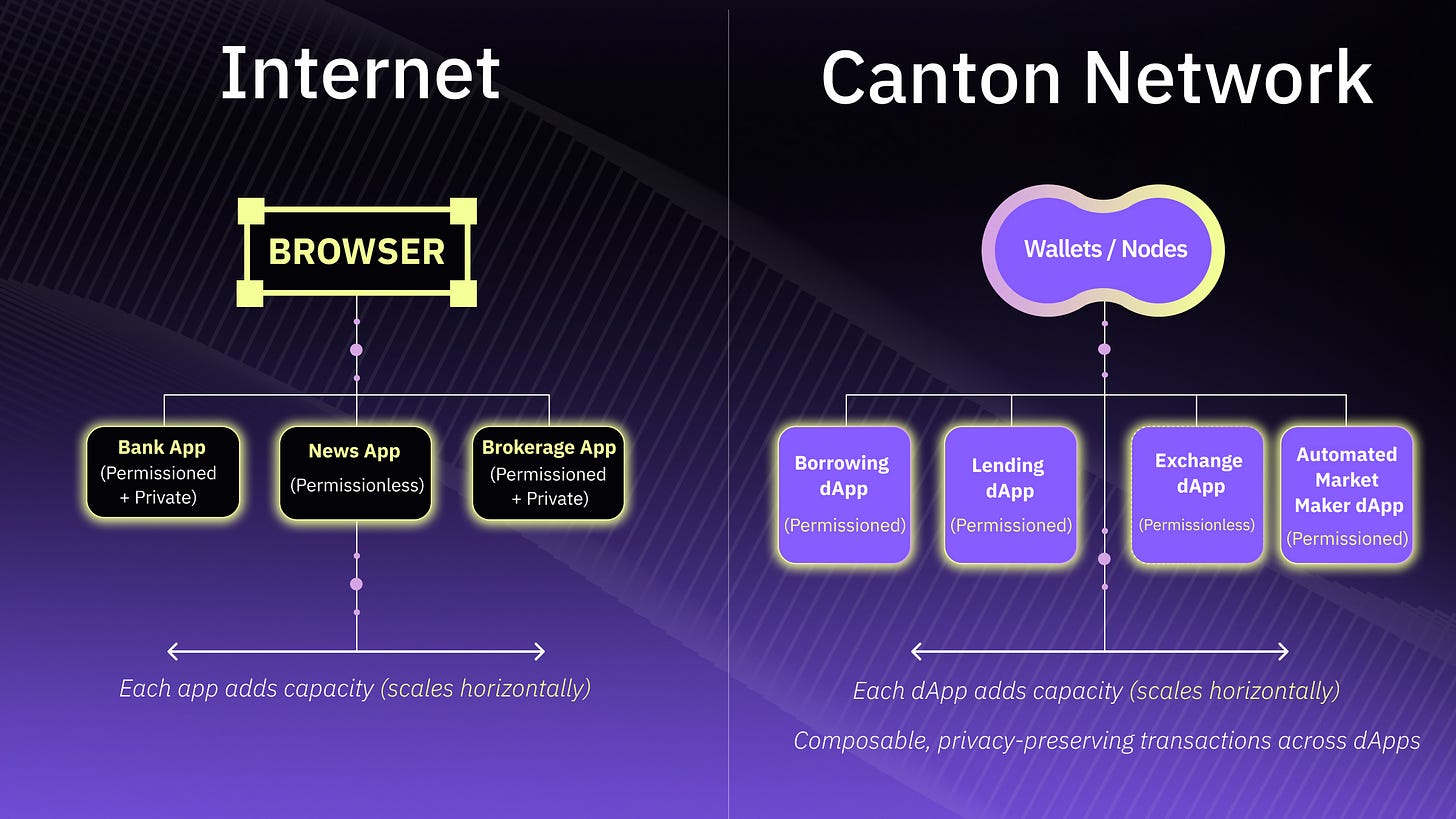

Canton Network is a Network of Networks!

Let’s now explore

what is under the hood of the Canton Network?

What makes it so special?

To make it easier to understand, let’s compare the Canton Network to the well-known Ethereum.

1. Data Architecture

Ethereum:

Everyone shares a single “fat ledger” (global ledger).

Each node stores all transactions and state (replication).

Canton:

Each node only has its own portion of the ledger (only the transactions it participates in).

The ledger is sharded, not fully replicated.

Difference: Ethereum = a single global ledger, Canton = a network of private ledgers connected by synchronizers, making the network lightweight, less resource-intensive, and private.

2. Privacy

Ethereum: All transactions are public, visible on the blockchain (even if the data is encrypted, the transaction is visible to everyone).

Canton: Transactions are private by default—visible only to the parties involved and authorized participants.

Canton Coin is an exception; its transfers are public specifically for metrics and transparency.

Difference: Ethereum = complete transparency, Canton = privacy by default + public signals where needed. This strikes a perfect balance for institutional players and businesses, enabling them to retain corporate confidentiality while remaining transparent enough to pass necessary compliance checks, desk audits, and audits.

3. Consensus

Ethereum: Shared Proof-of-Stake (PoS) — validators confirm blocks for the entire network.

Canton: Consensus is achieved on a per-transaction basis and only between the parties to the transaction (per-transaction Proof-of-Authority).

Synchronizers (e.g., Global Synchronizer) organize messages and ensure fairness.

Difference: Ethereum = global consensus, Canton = local consensus for each transaction. This enhances privacy (unnecessary participants cannot see the transaction), scalability (no global congestion), and efficiency (faster confirmation).

4. Smart Contracts

Ethereum: One standard – EVM. Contracts are written in Solidity.

Canton: Contracts are written in Daml (a business logic language), allowing for the integration of different applications.

Difference: Ethereum = a universal machine, Canton = a network of interconnected applications.

Daml is a language designed for describing business logic and access rights, rather than low-level code like in the EVM. It immediately defines who can do what in a contract, reducing errors and bugs, and making it suitable for banks, exchanges, custodians, and corporate networks where privacy, compliance, and legal certainty are vital.

BTW. EVM compatibility is being developed through Polyglot Canton.

5. Token and Fees

Ethereum: Gas must be paid in ETH; otherwise, the network won’t work. ETH serves as both fuel and asset.

Canton: Canton Coin is optional.

Traffic can be paid for through a third party using fiat.

Canton Coin (CC) is needed for incentives, fees, and public metrics, but the network can be used without it.

Difference: Ethereum = ETH is required, Canton = CC is optional, utility-driven.

This lowers the barrier for banks and companies, while the CC token remains a tool for economic incentives and transparent network activity metrics.

6. Network Topology

Ethereum: One global network, everything on one ledger.

Canton: “Network of networks” – multiple synchronizers (centralized or decentralized) interconnected.

You can run your own private or public synchronizers.

Difference: Ethereum is a single network for everyone, Canton is a network of multiple interconnected networks (mesh).

This setup enables the unification of independent private subnets and applications into a single ecosystem with secure atomic transactions between them.

Conclusion:

Ethereum is a single, transparent global blockchain.

Canton is a network of private mini-blockchains, linked through synchronizers, with a token for incentives but not necessary for use. It offers scalability, flexibility, and privacy that are impossible to achieve with a “single global ledger” like Ethereum.

However, none of the current alternatives such as Celestia, SKALE, Hyperledger, Polkadot, or other modular and networked blockchains provide transaction-level privacy or the same level of flexibility as the Canton Network.

⚠️It’s important to note one more thing!

Canton Coin is the native utility token of the Global Synchronizer — the first decentralized synchronizer running on the Canton Network.

The Canton Network can consist of multiple Synchronizers, each of which can operate using Canton Coin, its own token, or even accept fiat payments exclusively, without the need for cryptocurrency.

In other words...

Important Fact!

Canton Coin is not the only native token of the Canton Network.

Canton Network Architecture

We have nearly understood the concept of Synchronizers in Canton Network. To explain how they work, we first need to understand the architecture of the Canton Network itself.

For clarity, let’s break down the Canton Network layer by layer, like a Russian doll.

Layer 1: Canton Network — Protocol

Canton Network runs on a single protocol that ensures all network participants communicate in the same “language” and can perform atomic transactions based on consistent rules, even in a data-sharded environment.

Digital Asset developed the protocol and is open source.

The main goal of this protocol is to ensure interoperability. This means that different systems can work together and “understand” each other by exchanging data and transactions.

In our world, the equivalent of the Canton Network protocol is, for example, international driving rules or English as the universal language of communication.

The Canton Network protocol sets mandatory rules for all participants:

Data sharding – each participant stores only their transactions and data related to their transactions. No one can replicate the “entire ledger” or see transactions of others.

Per-transaction consensus – consensus is reached only among the parties involved in that specific transaction. Other network participants must not interfere or view someone else’s transaction.

Privacy and need-to-know access – transaction data can only be seen by authorized participants. Even the synchronizer operator does not have the right or technical ability to read the contents.

Unified synchronization protocol – all nodes, applications, and synchronizers must follow the common Canton protocol. This ensures transactions can be safely transferred between different synchronizers.

Transaction atomicity – a transaction is either fully executed (all steps) or rolled back. This is also known as the DVP (delivery versus payment) rule. Basically, goods and money are exchanged simultaneously and strictly without exception.

The protocol does not permit partial results, such as “money left, but the asset never arrived.”

Banks, exchanges, and custodians use DVP to prevent risks of “non-delivery” or “non-payment.” Canton integrates this feature at the smart contract and synchronizer levels.Authenticity verification – each node must cryptographically sign transactions. Participants need to be identifiable.

2/3 Super Validator Vote – changes to the system or protocol require approval from at least two-thirds of the Super Validators. No one can unilaterally alter the network rules.

⚠️It’s important to note!

The Canton Protocol itself supports both centralized and decentralized synchronizers.

Layer 2. Synchronizer

Thanks to interoperability, an unlimited number of Synchronizers can exist within the Canton Network.

To draw an analogy with our world, the Canton Network is a separate planet, and a Synchronizer is a distinct country, like a state on that planet.

Like any normal country, a Synchronizer maintains order, ensuring all citizens follow the rules, that everyone’s rights and responsibilities are respected, and that each individual is rewarded based on their merit.

Similar to a real country, each Synchronizer has its own internal currency.

Currently, there is only one public Synchronizer available to anyone on the Canton Network—the Global Synchronizer.

Since the Global Synchronizer is currently the only active synchronizer operating on the Canton Network, most network activity and token utility presently revolve around Canton Coin.

The emergence of other Synchronizers with their own internal currencies will probably not reduce demand for Canton Coin, but instead strengthen its role as a standard unit of measurement across the entire Canton Network. An analogy to the US dollar in our world is also quite fitting here.

⚠️It’s important to note!

The Canton Foundation, formerly known as the Global Synchronizer Foundation (GSF), acts as one of the Super Validators and provides a forum for governance discussions and record-keeping. Still, it does not control or monopolize either the synchronizer or the Canton Coin.

A reasonable question arises -

Why is this interoperability important? Why can’t we build a single decentralized network like other blockchains?

There are several reasons:

1. Flexibility

Different companies in various jurisdictions and countries have their own policies and requirements for compliance, financial reporting, and tax reporting, as well as different attitudes toward cryptocurrency as a payment method.

The flexibility of the Canton protocol allows, for example, a bank in Asia to operate within a single environment, even if the country hosting the synchronizer is entirely against cryptocurrency and processes all settlements through bank acquiring. This could be the case if cryptocurrency is banned in that jurisdiction.

Another exchange operates in a European synchronizer with its own rules and privacy policies.

Thanks to a unified protocol, the bank in Asia and the European exchange can operate independently within their own synchronizers and, if needed, securely and instantly conduct transactions with each other without violating the policies of their respective synchronizers.

2. Scalability

Another clear advantage of this model is the scalability of the Canton Network. It has no limits. The Synchronizer code is open source, and anyone can launch their own mini-state on the Canton Network.

I anticipate high demand for this model among corporate entities and even individual countries.

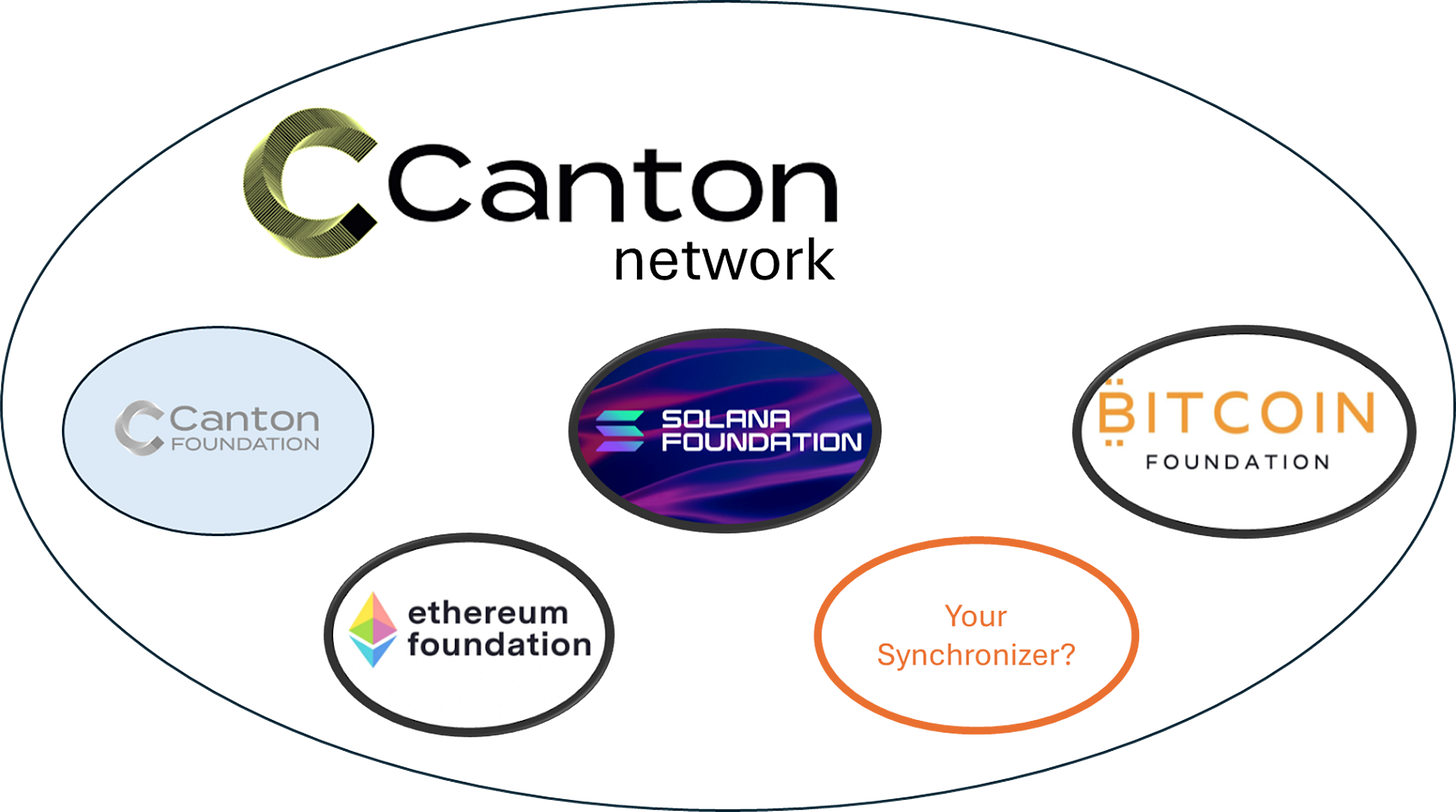

In the diagram above, I illustrated the foundations of various well-known blockchain networks. Canton Network has already attracted companies that contribute to a third of the world’s GDP.

It’s clear to me that blockchain and cryptocurrency projects of all sizes will want to communicate using the same “language” as global economic leaders and will join the Canton Network by launching their own Synchronizer or connecting to an existing one.

3. Privacy

Privacy is a key feature of the Canton Network. Unlike Monero and Zcash, where everything is encrypted for everyone, the Canton Network manages privacy, making it ideal for banks, exchanges, and corporations.

Transaction details are only accessible to the involved parties.

Nodes unrelated to a transaction won’t even be aware it exists. This is thanks to the decentralized ledger.

This gives the Canton Network an edge over Bitcoin and Ethereum blockchains, where the entire ledger is publicly accessible, allowing everyone to view all transactions.

It’s also important to note that even Synchronizer operators do not have access to message content. Data is always encrypted and can only be decrypted by those with a “need-to-know.”

Synchronizer operators cannot read transactions; they only ensure the correct order of message processing.

4. Fault Tolerance

This feature is straightforward: if one Synchronizer crashes or becomes overloaded, the network continues to run by redistributing the load to other synchronizers.

5. Innovation

The flexibility of the Canton Network protocol allows anyone to launch their own Synchronizer, which can have different reward systems, policies, and other features as long as they don’t conflict with the protocol.

The Synchronizer itself doesn’t receive a reward, but it can incentivize participants to use its services. The more super-validators, validators, and regular users there are, the more influential the Synchronizer becomes in the network.

The reward system within the Synchronizer is also intriguing.

For example, within the Canton Foundation, everyone earns a network reward proportional to their contribution. The more new users your validator gains, the more fees generated from your applications, and the more transactions you validate, the higher your reward.

This economic incentive encourages entrepreneurial initiatives, boosts competition, motivates participants to develop new products, offers high-quality services, and invests more in marketing, thus strengthening the entire Canton ecosystem.

Layer 3. Supervalidator (SV)

A super validator (abbreviated SV) combines two roles:

1. A validator (which we’ll discuss in more detail below)

2. A synchronizer node — in other words, without an SV, the Synchronizer cannot function.

Why does a Synchronizer need SVs?

We’ve discussed that there can be an infinite number of Synchronizers in the Canton Network. They can vary greatly, but all must follow the Canton Network protocol.

The core of this protocol is the Byzantine Fault Tolerance (BFT) consensus mechanism.

This consensus operates on a simple rule: a decision is considered unanimous if two-thirds of the votes are in favor.

According to the Canton Network protocol, a Synchronizer cannot be centralized and must include at least three SVs to maintain a quorum. Ideally, the number of SVs should be a multiple of three to ensure the Synchronizer remains stable even if several SVs fail.

Based on data from https://canton.thetie.io/ , Canton Foundation the Canton Network’s main and only Synchronizer, currently has 32 Super Validators. While this isn’t a large number, it still demonstrates the network’s high fault tolerance.

Along with ensuring consensus and the Synchronizer’s reliability, SVs perform essential functions such as maintaining the address book—the Name Service, which helps all network participants identify each other—and organizing and timestamping messages and transactions.

It’s important to note that all Synchronizer actions, every operation, occur within a BFT consensus framework—this applies to every transaction, including fees, rewards, and updates. Any decision is made through SV consensus.

Layer 4. Validators, Applications, and Regular Users

Let’s take a closer look at roles such as user, application provider, and validator.

1. User

The user is the most basic role in the Canton Network, shared by all network participants.

Each owner of a non-custodial wallet has a record in the validator node that stores all transaction details and user data related to that specific wallet.

If a user owns several different wallets, for example, one in Cantonwallet, another in Cantonloop, and a third in Bron, this means they are using three independent nodes in the Canton Network.

What can a user do in the Canton Network?

Send and receive tokens (e.g., Canton Coin)

Use applications (smart contracts, trading platforms, custodial services, etc.)

Sign transactions and contracts.

2. Application Provider

This is a Canton Network User who is a developer or organization creating a smart contract, product, or service on the Canton Network using the Daml language.

This includes any web3 application that already exists on other blockchains.

What does an Application Provider do on the Canton Network?

Attract users to use their application and receive rewards for each new user.

Provides the logic of the Canton Network protocol (e.g., the principle of atomic transactions).

Earn Canton Coin rewards (via minting) for user activity within the application.

It’s important to note! In addition to profiting from the sale of the service itself, the Application Provider earns from any user actions within the application that result in transactions and commissions.

The Application Provider earns CC through minting, which is distributed proportionally to the usage of their application.

Consequently, more transactions and application users → higher rewards for the provider.

3. Validator

This is a node owner who serves users and applications.

What does a Validator do in the Canton Network?

Validates transactions originating from users and applications

Stores contract state

Ensures access rules and logic in Daml are followed.

Validators receive a reward (through the right to mint CC) for performing these tasks.

Unlike supervalidators, regular validators do not participate in the global consensus of the synchronizer, but only serve their portion of the network.

It’s important to note!

A validator does not necessarily have to be an application provider, and an application provider does not necessarily have to be a validator.

However, an Application Provider can be a Validator, and this is beneficial for several reasons:

As an Application Provider, you create a transaction flow and, as a validator, you validate them—this provides even more privacy and reliability, which is essential for banks, exchanges, brokers, and other participants in the financial industry.

You receive a reward as a Mint CC as an Application Provider for active interactions with your users’ applications and as a Validator, who provides application support.

✅Fun fact!

The waiting list for inclusion on the validator list currently exceeds 2,000 companies worldwide, and this is despite Canton still not receiving widespread publicity.

❓How to become a Validator on the Canton Network?

Currently, there is only one Synchronizer—the Canton Foundation—where you can become a validator.

To become a validator, apply here: https://sync.global/validator-request/

✳️Summary: The Entire Canton Network Architecture

1. Canton Network Protocol — Canton’s constitution, a global set of rules and principles that all network participants must follow.

2. Synchronizers — a council or association of supervalidators who establish their own incentive and reward systems, currency, and payment methods.

3. Supervalidators — manage the entire network: they streamline transactions, ensure consensus, and guarantee transaction atomicity. They operate exclusively within the Synchronizer, following the BFT consensus.

4.1 Users — utilize applications, create transactions, and pay fees for using the network.

4.2 Applications — offer services and earn rewards in CC, the amount depending on the transaction volume generated by users within each application.

4.3 Validators — serve users and applications by verifying transactions.

Canton Coin Tokenomics

Canton Coin is the native utility token of the Synchronizer, the Canton Foundation, in the Canton Network.

As of October 2025, 32 billion CC tokens have been issued.

While there is no cap on token issuance, it is divided into several stages.

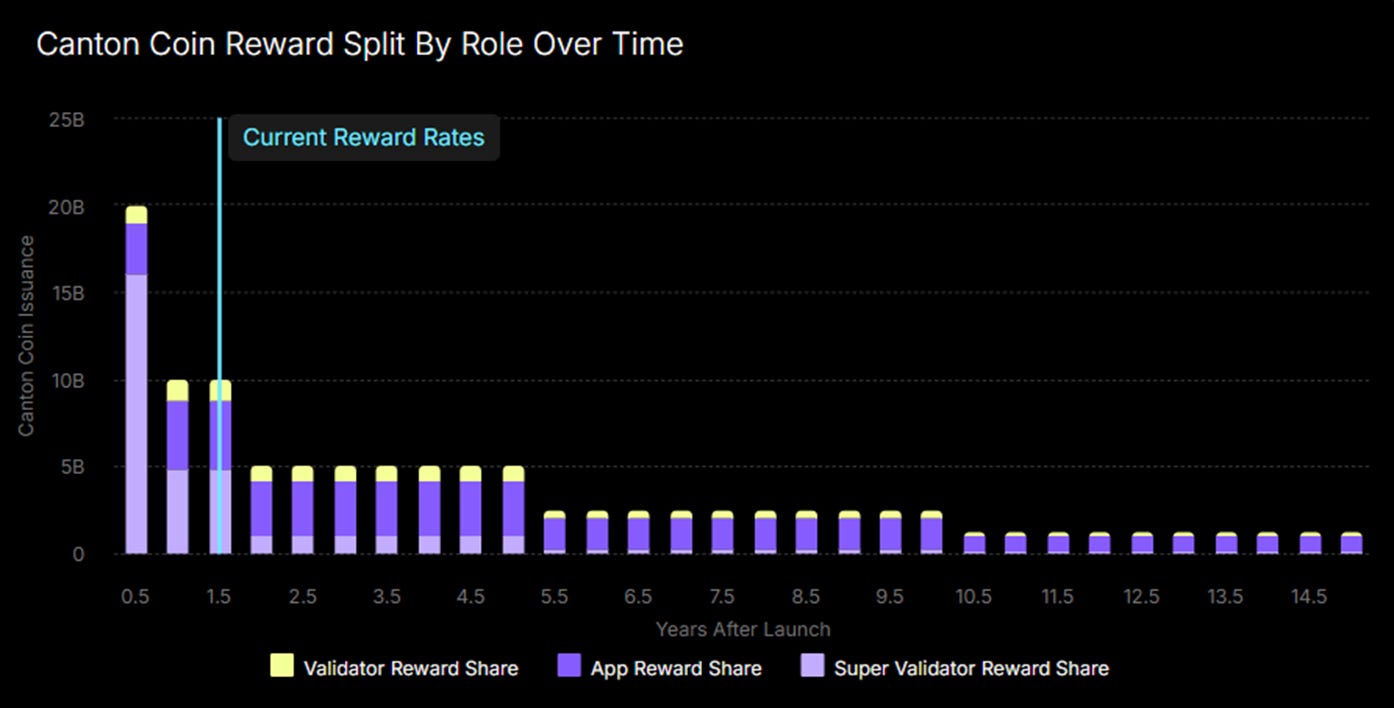

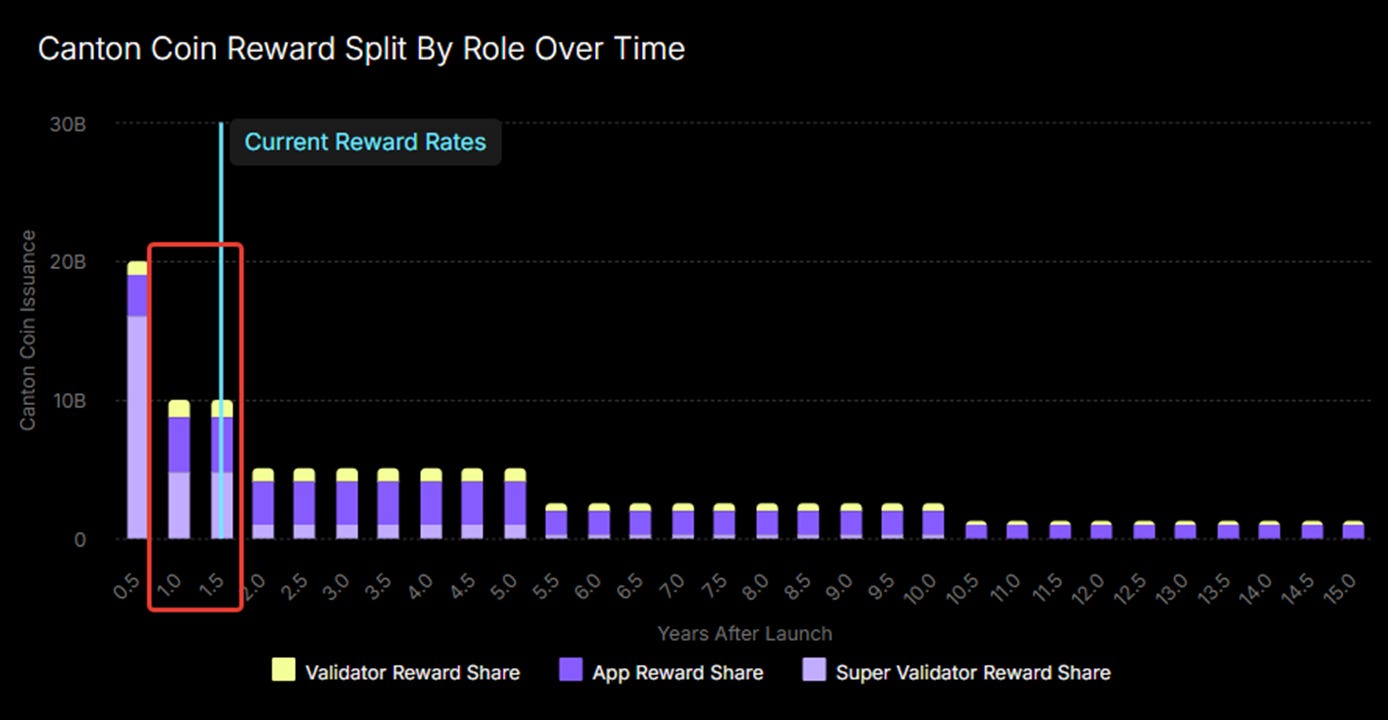

The chart below best illustrates these CC issuance stages.

It is important to note that the stage names are purely imaginary and are used better to explain the Canton Network’s core development strategy.

Stage 1. Network Launch (First 6 Months)

The chart above shows that the largest issuance occurred during the first six months after the network launch.

During this period, 20 billion CC tokens were issued, with 16 billion allocated to Super Validators—the backbone of the Synchronizer.

The remaining 3 billion went to Application Providers, and 1 billion to Validators.

Stage 2. Infrastructure Construction (1 year)

We are currently in the second half of this stage.

Its main feature is a significant reduction in CC issuance, halving it to $10 billion every six months.

During this phase, CC issuance is focused on encouraging infrastructure development. The reward for application owners has not decreased; instead, it has increased to 4 billion CC. Validator rewards have also gone up to 1.2 billion.

These measures make sense. The project is entering a phase of active growth and preparing for its market launch. Valuable infrastructure and services are essential for CC token utilization after listing on exchanges.

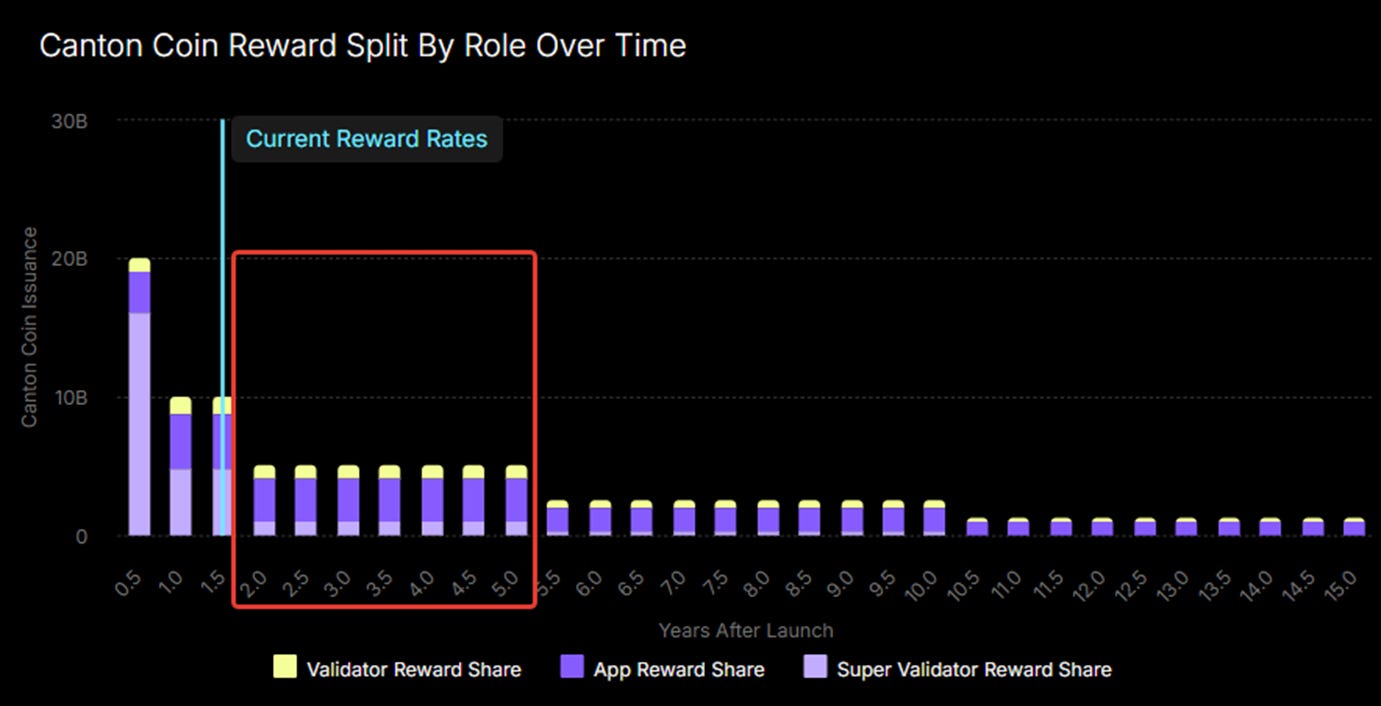

Stage 3. World Conquest (3.5 years)

I decided to name this stage this way for a simple reason: it coincides with the period of active CC listings on top exchanges. Personally, I expect listings on at least Kraken (already officially confirmed), Coinbase, and Binance.

During stages 1 and 2, Canton Network was virtually unknown, and there was practically no promotion.

In stage 3, I expect increased marketing efforts from both the Canton Foundation and the network’s core participants—Super Validators, Validators, and Application Providers.

https://x.com/YuvalRooz/status/1971152490319282433

During this period, the supply will be halved, reaching 4 billion tokens every 6 months.

The distribution ratios will also change significantly:

1 billion will go to SV

0.9 billion to the Validator

3.1 billion to Applications

The reduced supply will definitely lower selling pressure in the market, and application owners will receive excellent support for business growth!

At the same time, aggressive marketing will boost hype around the coin and push it to the top of the market in terms of total market cap.

At this stage, the entire world will learn about Canton Network and eagerly study, discuss, and test its capabilities.

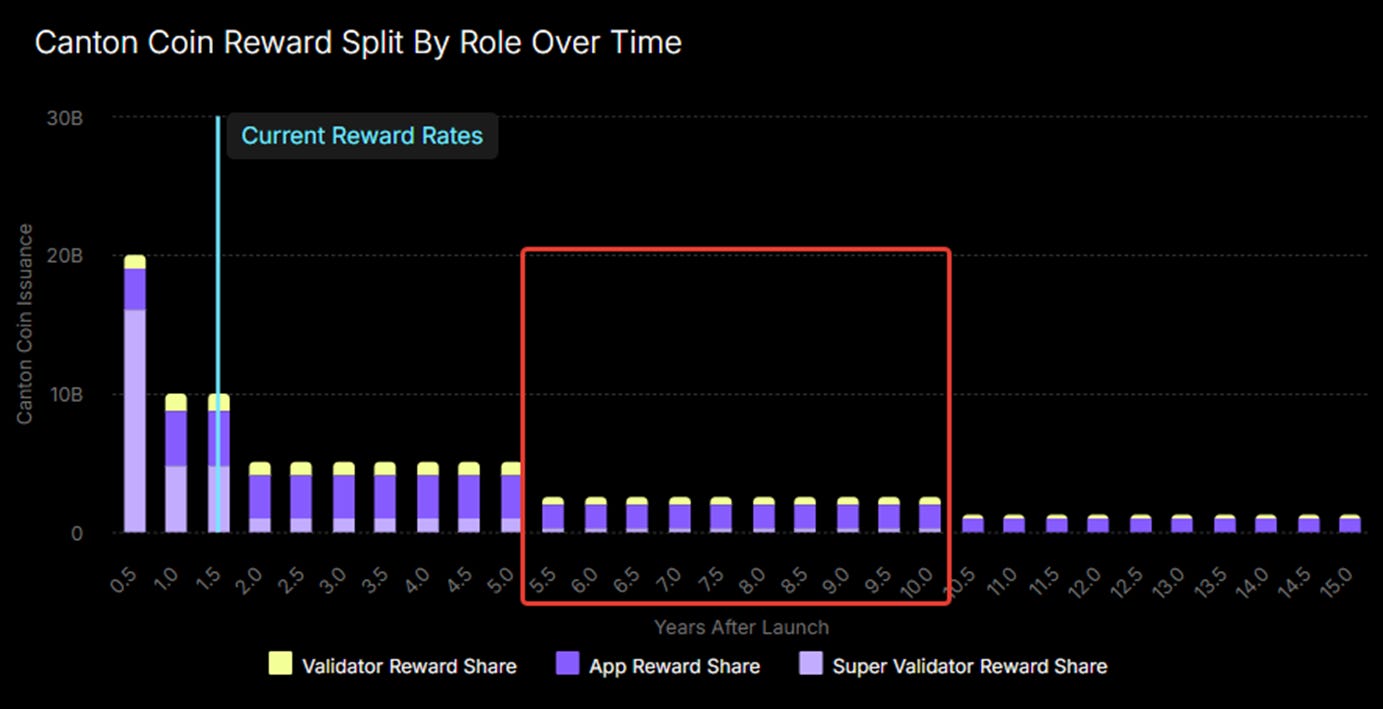

Stage 4. Consolidating Positions (5 years)

When we reach Stage 4, the Canton Network will have completed five years of mainnet operation.

During this period, 75 billion Canton Coins have already been issued.

All familiar Web3 services are now implemented on the Canton Network, and we are actively working to establish it as a recognized platform for building a new generation of online businesses, known as Web 4.0.

By this time, new Synchronizers are being built and developed within the Canton Network, representing teams from major cryptocurrency projects, institutional players, and global economic leaders. The emergence of Synchronizers representing individual countries’ interests is also possible.

The Canton Foundation continues to support Application Providers, maintaining its role as the primary builder and sponsor of startups within the Canton ecosystem.

Stage 4 also signifies the next halving of Canton Coin supply.

Now, every six months, only 2.5 billion Canton Coins are issued, distributed as follows:

0.250 billion to SV

0.525 billion to the Validator

1.725 billion to Applications

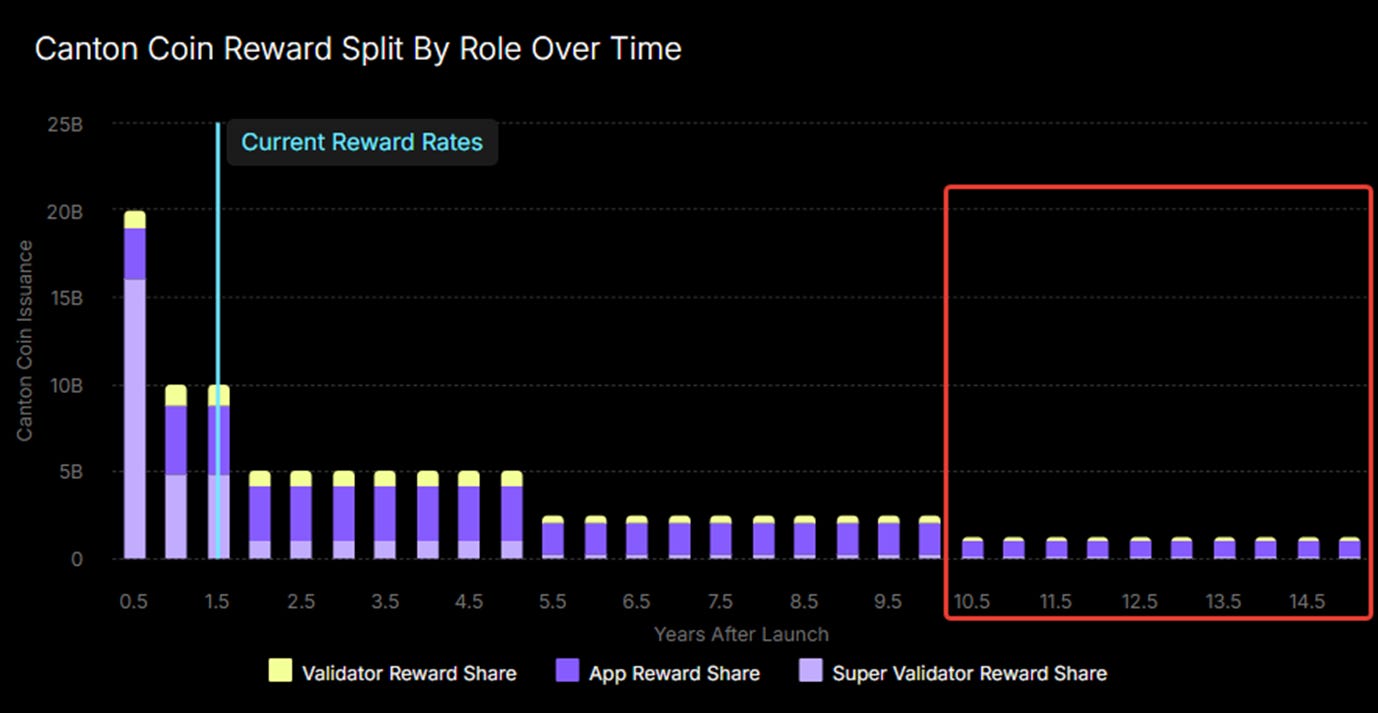

Stage 5. Revival (∞ years)

Canton Network has completed 10 years of operation.

A total of 100 billion Canton Coins have been issued, distributed in varying proportions across all four stages.

Calculating from start to finish:

35% of the issued CC went to SV

50% were withdrawn by Application Providers

15% by Validators.

At this point, Canton Network ranks among the top by market capitalization. It has proven its value and established itself as the new standard for online businesses.

People no longer distinguish between Web2 and Web3 projects. Instead, they differentiate between those within Canton and those outside of it.

The majority of the Web3 market has moved to the Canton Network.

Meanwhile, the Web3 market has dwindled to a niche among a small community of enthusiasts and has faded into obscurity, primarily operating within black market spheres.

The cryptocurrency market is experiencing a renaissance.

Just as humanity shifted from the Middle Ages to the Revival, at Stage 5, cryptocurrency finally became a true participant in the global economy, and the Canton Network blockchain has become as standard for web-based commerce as Windows/MacOS is on laptops or Android/iOS on smartphones.

At Stage 5, the final halving of CC coins occurs.

1.25 billion coins are issued every six months, allocated as follows:

625 million — SV

250 million — Validator

937.5 million — Applications

Minting at these proportions will continue indefinitely, contributing to the token’s built-in constant inflation of 2.5% annually

Core Mechanics of CC Distribution

We’ve covered all five stages—five hypothetical phases of token distribution.

⚠️It’s important to note!

Regardless of the phase we’re currently in, token minting is always subject to a mechanism for balancing burned and issued tokens, which is called Equilibrium.

Equilibrium is a distinctive and unique feature of Canton Coin, unmatched by other blockchains:

1. Token minting is directly tied to on-chain activity.

Validators receive rewards proportional to the transactions processed.

Supervalidators receive rewards proportional to the number of participations in accepted consensuses

Applications receive rewards proportional to the number of user transactions

Minting is not strictly tied to a new block in the blockchain. The number of issued tokens in a block may vary. If network activity declines, minting also decreases, reducing price pressure. This balances the economy.

2. All network fees are used to burn the CC token.

The Canton Network is, in fact, the first network where tokenomics is built not to manage token prices, but to self-regulate the economy's balance—a self-balancing token economy with a small inflation rate built in.

When activity increases → minting increases, but so does burning (burn through fees).

When activity decreases → both minting and burn decrease, and the network economy “calms down.”

This creates automatic self-regulation, without manual inflation control.

I find the Equilibrium principle extremely fair because it filters out participants who, for whatever reason, are inactive and do not contribute to the network's development.

If an application is not in demand, users avoid it, and the provider of that application will receive significantly less reward. This approach stimulates competition and economic activity within the network, attracting successful participants from all over the world.

Canton Coin – What is the future Price? (Instead of a conclusion)

What is the future price of Canton Coin?

This is perhaps the primary concern for all market participants.

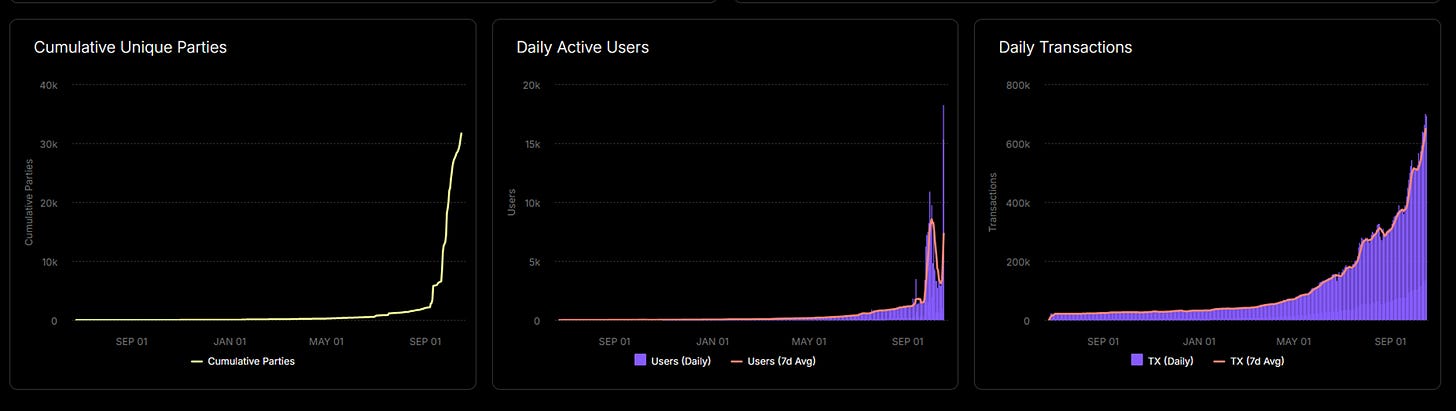

The explosive growth of network activity began in September, and by the end of October 2025, the number of active users is approaching 16,000, while the total number of wallets is nearing 20,000.

The growth figures are impressive, but the overall statistics suggest that we are still in the early stages.

At the same time, Canton Coin (CC) is not yet traded on open exchanges and is only available on the secondary market.

There, its price fluctuates between 0.12 and 0.24 USD.

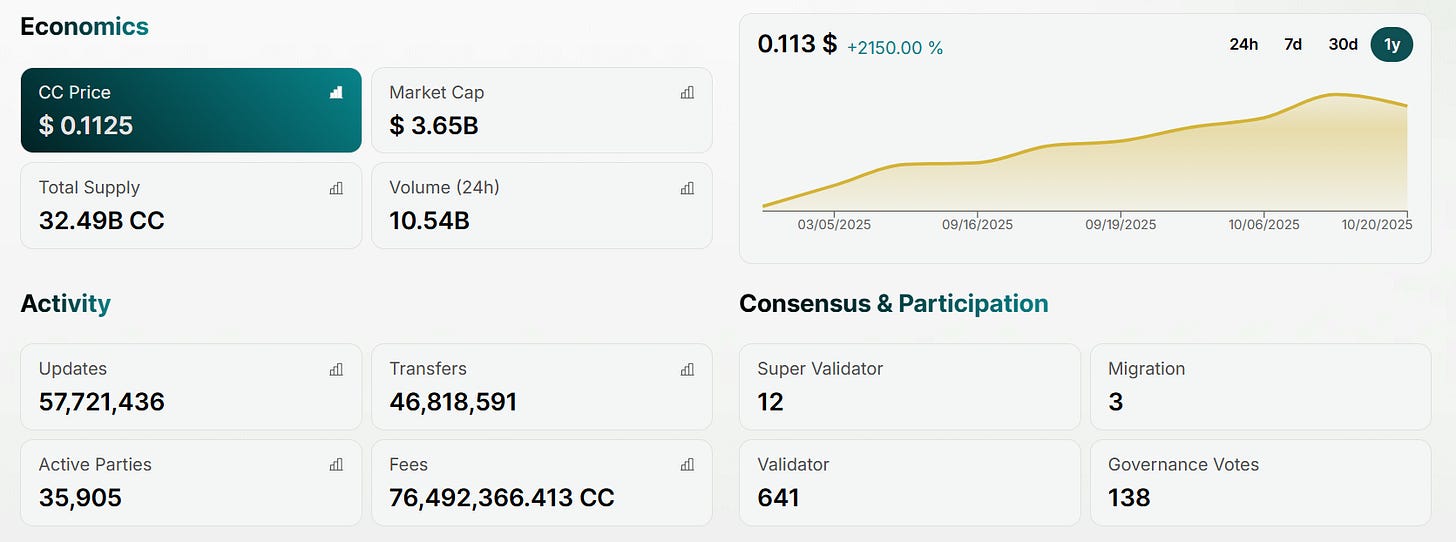

CC also has an internal network exchange rate of 0.1125 USD, which is periodically adjusted by Super Validators’ consensus based on changes in the secondary market.

As I mentioned earlier, one of the features of the Canton Network is the ability to pay for network operations not with CC but with fiat currency, such as USD. All accrued fiat will be used to purchase the CC token and subsequently burn it.

The internal rate is used to calculate the cost of Canton Network services in USD for internal users.

Network fees are also tied to the internal rate, protecting users from speculative fluctuations in the CC price on the market.

This isn’t financial advice, but my instinct as a trader with 16 years of experience tells me that this level will provide excellent support for buyers during strong declines.

I’m really looking forward to the start of open trading to test this hypothesis :)

Even taking into account the internal technical rate of 0.1125 USD, and considering the total volume of issued tokens (approximately 32B), we get a CMC of ~4B USD.

https://ccview.io/

For a project whose token isn’t yet traded on any exchange, this is an incredibly high figure. In my 11 years in crypto, I’ve never seen anything like this.

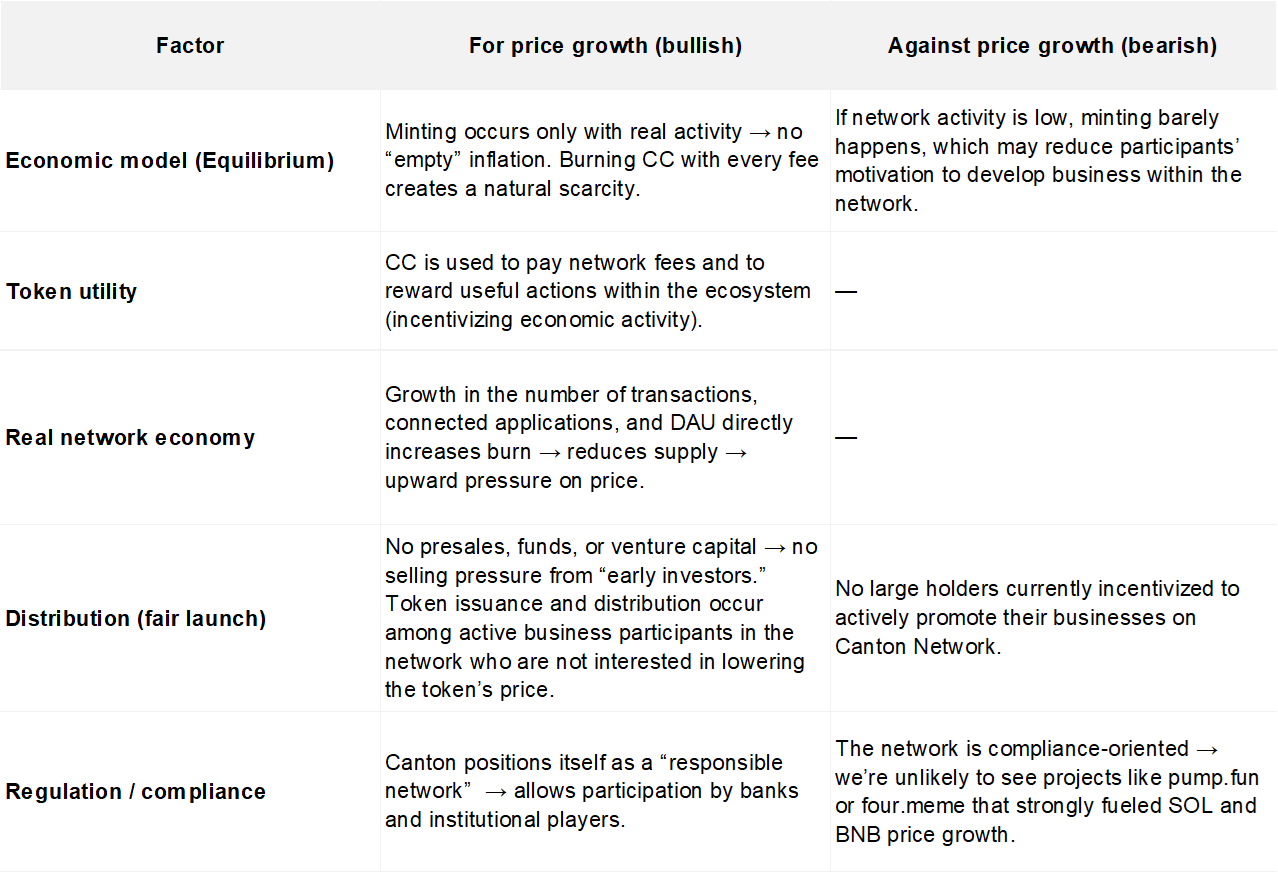

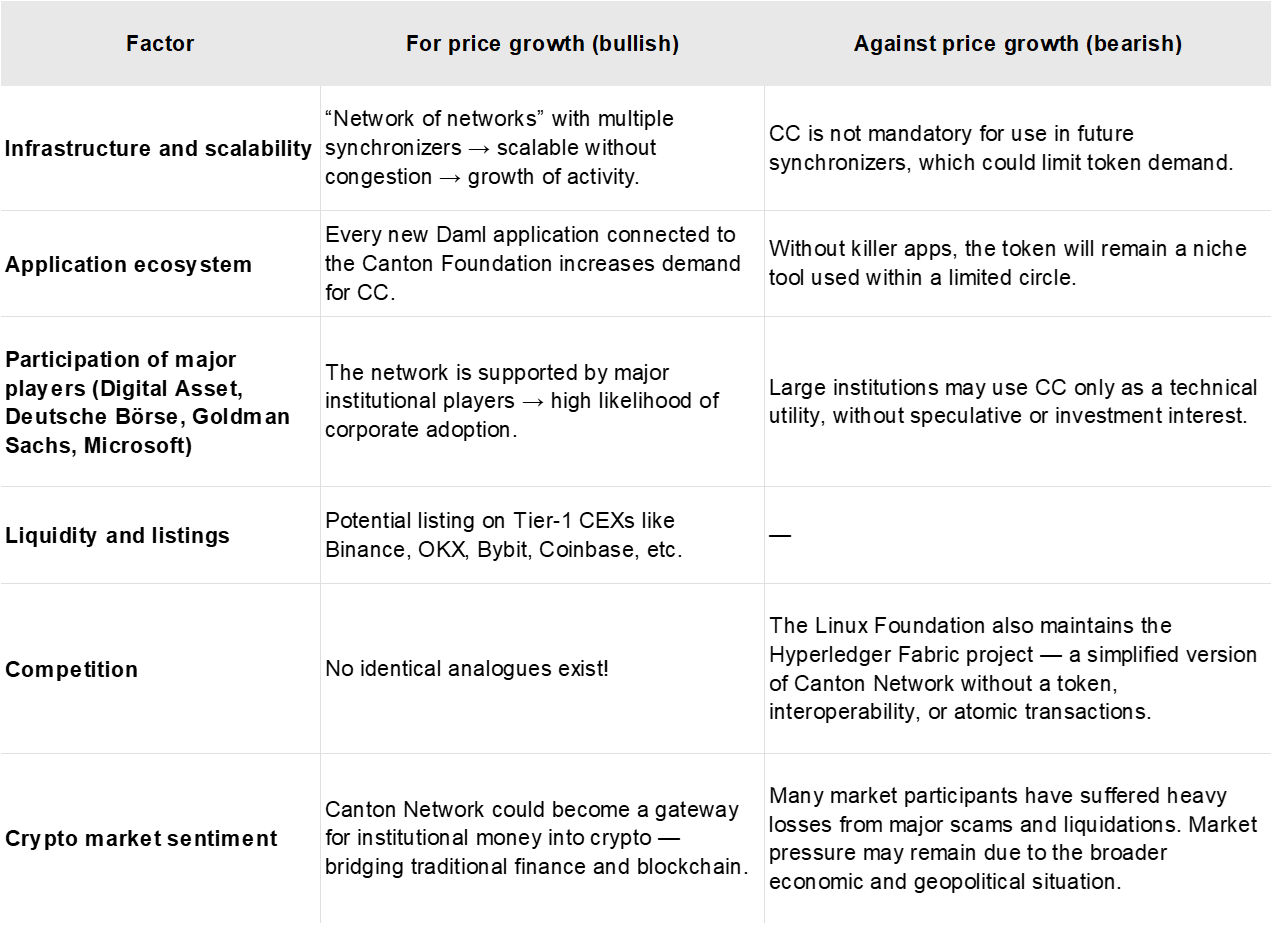

To assess whether CC has a chance for further growth, I recommend weighing the pros and cons of potential expansion and performing a factor analysis..

Factor analysis of Canton Network

A factor analysis indicates that Canton Coin faces clear barriers that could hinder price growth, with the most notable being the overall instability and unpredictability of the current market environment. At the same time, Canton Coin possesses several internal factors that may help stabilize and support its price during a bear market.

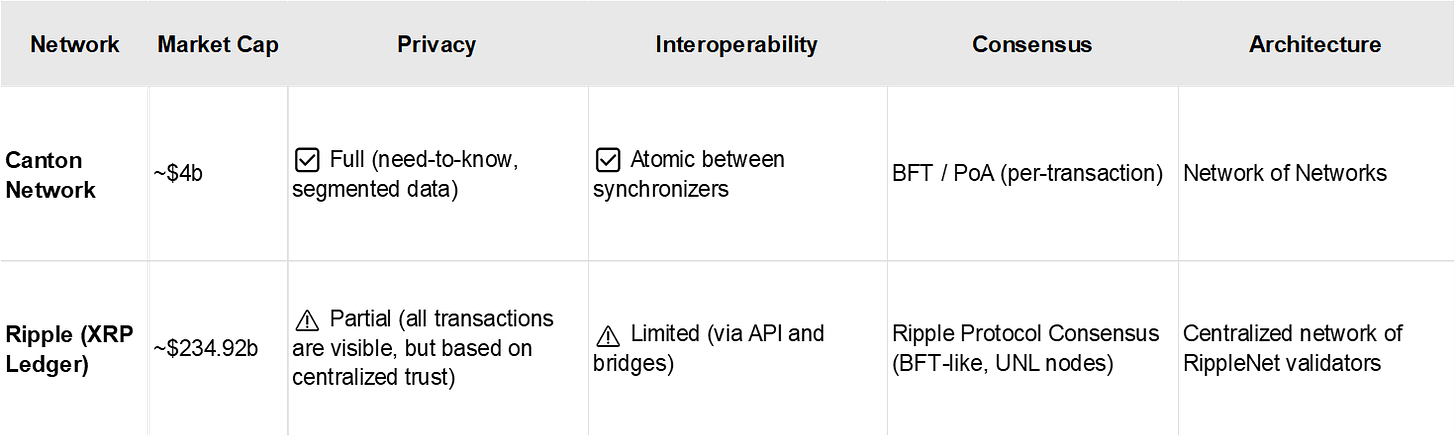

Competitive Analysis of Canton Network

To assess the potential price of CC, it’s useful to examine successful blockchain networks in the current market.

Regarding the “Network of Networks” idea, the closest examples are Cosmos and Polkadot. However, they aren’t full competitors since they aren’t designed for corporate use. All transactions on these networks are public.

The nearest competitor in terms of compliance and institutional integration is Ripple (XRP Ledger), which was originally built for banks, credit unions, clearinghouses, and interbank settlements.

Both Canton and Ripple were designed with regulatory compliance in mind: KYC, AML, and transparency for financial institutions.

Both networks confirm transactions within seconds and do not require mining or energy-intensive processes. They also use their own native tokens for paying network fees.

I’ve included some additional comparison details in the table below:

As we can see, XRP and Canton Coin share many similarities. Still, fundamentally, Canton is an “evolution of Ripple’s ideas,” adapted for the Web 4.0 era—creating a Network of Networks where:

privacy by default,

atomic interoperability,

optional token,

neutral governance through the Linux Foundation.

Canton Network accomplishes what Ripple has not—becoming a gateway to the blockchain world for widespread adoption by businesses, corporations, and institutions.

I’ve heard discussions about the mass adoption of cryptocurrency for years. Still, like any product or service, it won’t become mainstream until large corporations start using it and integrating it into their operations.

Just as every small organization once felt it necessary to have a personal website and email address, every startup will likely soon need to have an active node or, at the very least, a wallet on the Canton Network.

https://x.com/CantonNetwork/status/1975154102314349051

How much will Canton Coin be worth?

That remains a rhetorical question.

We don’t have a crystal ball and can’t predict the future. However, one thing is sure:

✅ Canton Network is an exceptional project with the potential to revolutionize the cryptocurrency industry and unify large institutional businesses with crypto.

In this context, it’s easy to envision Canton Coin among the top market cap listings or at least ranking alongside Ripple.

When will Canton Coin (CC) be listed?

Rumors suggest a Kraken listing will occur before the end of October. I’ll add a direct link here once the listing is complete.

Top exchanges and trading platforms are also slated for listing. These include Binance, ByBit, OKX, BitGet, MEXC, and eToro.

All of the listed exchanges have already launched their nodes on the Canton Network blockchain:

binance-dp-1: 12206a8a77e900f10dbaa57e4741f2d50d9318dd87e40f8dbf28f7ec4da657bb27b4

ByBit-MainNetValidator-1: 12202c9fc5180723f14e87c88d316355817dd565afc2a897706a789086c33cd6a095

okx: 1220409a9fcc5ff6422e29ab978c22c004dde33202546b4bcbde24b25b85353366c2

mexc-mainNetPrimary-01: 12209e60476146f76117509a8f7ac4337e68bfe47da95ce5052ae6d30b81a790f6ba

bitget-validator-1: 122048da98d2d6d5fec66f4dae151983c9d3925dafe78d28e0a17ba4c7ca905bf2ca

eToro-mainnetValidator-1: 12209e5264f0c7680d2cdd492b0a45733d8188a626840ad172a3b8033583d2f17b30

This is a qualitative indirect sign that the CC will be integrated into the payment mechanisms of the listed trading platforms.

Where can I buy Canton Coin (CC)?

One of the most popular platforms for buying and selling CC right now is the Bron wallet

I’ve been using this app for a long time and am very satisfied with its reliability and quality of service. Bron is definitely one of my favorites among all the active apps in the ecosystem.

If you’d like to learn more about Bron, I invite you to read my article where I share 11 reasons why everyone will install Bron sooner or later: https://techhyvc.substack.com/p/11-big-reasons-why-you-and-everyone

While demand can’t keep up with supply and there isn’t enough liquidity in the market, I’ve decided to launch my own OTC platform for buying and selling CC:

https://1otc.cc/ or https://canton-otc.com/

I promise to offer more attractive exchange rates there, especially for large volumes. However, for security and quick development, all orders are processed manually, so you’ll need to wait after placing an order.

My backup channel for OTC trades is here: https://t.me/cantonotcdesk

At least three decentralized exchanges will also operate on the Canton Network:

CantonExchange — https://canton.exchange/ (still under development)

CantonSwap — https://cantonswap.com/ (the service is only available to node holders)

Temple — https://templedigitalgroup.com/ (promised to launch in the coming days)

It is also possible to buy CC directly from SVs and Validators. However, these trades are usually less secure, as scammers can easily target them. With the increasing popularity of the Canton Network, their number is rising every day.

The most current list of Super Validators can be found here: https://lighthouse.fivenorth.io/super-validators

And the list of validators is available here: https://lighthouse.fivenorth.io/validator

Useful links

The Canton Network ecosystem is actively growing, but there are still not many apps that are actually functioning.

The complete list of apps integrated into the Canton Network and verified by the network is available here: https://lighthouse.fivenorth.io/featured-apps

I will try to update this section as quickly as possible. If you’re launching an infrastructure app on Canton, please contact me to add it to the list below.

Dashboards

The Tie Dashboard — https://canton.thetie.io/

Explorers

Cantonscan — https://www.cantonscan.com/

Lighthouse — https://lighthouse.fivenorth.io/

Node Fortress — https://explorer.canton.nodefortress.io/

Canton View by pixelplex — https://ccview.io/

Wallets

Bron — http://support.bron.org/ (invite only)

5N Loop — https://cantonloop.com/ (invite only)

Canton Wallet by Send — https://cantonwallet.com/ (limited)

Official Canton Communities & Socials

Main Chat (Tg) — https://t.me/CantonNetwork1

Russian Chat (Tg) — https://t.me/Canton_Russia

Turkish Chat (Tg) — https://t.me/CantonNetwork1TR

Main (Drd) — https://discord.gg/canton

Main (X) — https://x.com/CantonNetwork

Main (Ln) — https://www.linkedin.com/company/canton-network

Main (YouTube) — https://www.youtube.com/@CantonNetwork

By the way, check out the two intro videos about Canton. Share your thoughts – which one you liked best in the comments:

Friends, if you’re reading this, you’re doing a great job 🫶

Thank you so much for your time.

If you notice any inaccuracies or need corrections, please leave a comment below. You can also find me on Tg @hypov or email me at start@techhy.me

Disclaimer

The materials in this publication are for informational and educational purposes only and do not constitute:

investment advice, financial, legal, or tax advice;

an offer or invitation to buy, sell, or exchange any assets, tokens, or securities;

a guarantee of profitability or risk-free performance of any strategies.

The author is not affiliated with and does not act on behalf of the Linux Foundation, Digital Asset, Canton Network, Canton Foundation, or any other companies or projects mentioned unless explicitly stated otherwise. The author’s opinions are subjective and may change without notice.

The information is obtained from public sources and is believed to be accurate at the time of publication; however, it is not guaranteed to be complete, current, or error-free. Digital asset markets are volatile; past performance does not guarantee future results. Any forecasts and scenarios are estimates and include forward-looking statements involving risks and uncertainties.

Please conduct your own research (DYOR) and, if necessary, consult independent certified professionals. The author and publisher are not responsible for any direct or indirect losses from using the information in this publication.

The trademarks and names mentioned belong to their respective owners. External links are provided for convenience and do not endorse their content; the author is not responsible for external materials.

This article may be updated as new information becomes available; some data might be outdated. For questions about corrections and clarifications, please contact the author at the address provided in the article.

![Canton_Network_-_Discover_how_leading_institutions_unlocked_tokenized_money_market_fun..._r3NWJc.mp4 [video-to-gif output image] Canton_Network_-_Discover_how_leading_institutions_unlocked_tokenized_money_market_fun..._r3NWJc.mp4 [video-to-gif output image]](https://substackcdn.com/image/fetch/$s_!T2BR!,w_1456,c_limit,f_auto,q_auto:good,fl_lossy/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F4431c2bf-f41e-4924-bdcc-2bd1adb0d421_800x800.gif)

![Canton_Network_-_You_wouldn_t_print_your_bank_statement_on_a_T-shirt._So_why_let_a_pub..._mRAPsQ.mp4 [video-to-gif output image] Canton_Network_-_You_wouldn_t_print_your_bank_statement_on_a_T-shirt._So_why_let_a_pub..._mRAPsQ.mp4 [video-to-gif output image]](https://substackcdn.com/image/fetch/$s_!Aumi!,w_2400,c_limit,f_auto,q_auto:good,fl_lossy/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F1ea82c5e-8bf4-4b59-b7a7-d454f615066f_720x720.gif)

![Canton_Network_-_Imagine_money_and_assets_swapping_in_seconds_not_days_and_without_tr..._lLaeo1.mp4 [video-to-gif output image] Canton_Network_-_Imagine_money_and_assets_swapping_in_seconds_not_days_and_without_tr..._lLaeo1.mp4 [video-to-gif output image]](https://substackcdn.com/image/fetch/$s_!1las!,w_1456,c_limit,f_auto,q_auto:good,fl_lossy/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F07874968-8ddc-417f-8b22-9a15f7dd9ef6_720x720.gif)

Great insight as always